In a world where markets swing between booms and busts, preserving wealth has become just as important as creating it. Investors today face unprecedented uncertainty — inflation spikes, geopolitical conflicts, volatile interest rates, and shifting currencies. Amid this turbulence, one truth remains constant: gold endures.

Gold has protected wealth for thousands of years, serving as a safe haven through wars, depressions, and financial crises. Yet in the modern investment era, the opportunity lies not just in holding gold, but in earning from it. That’s where gold bonds—and especially Compound Gold Bonds™ (CGB)—come in.

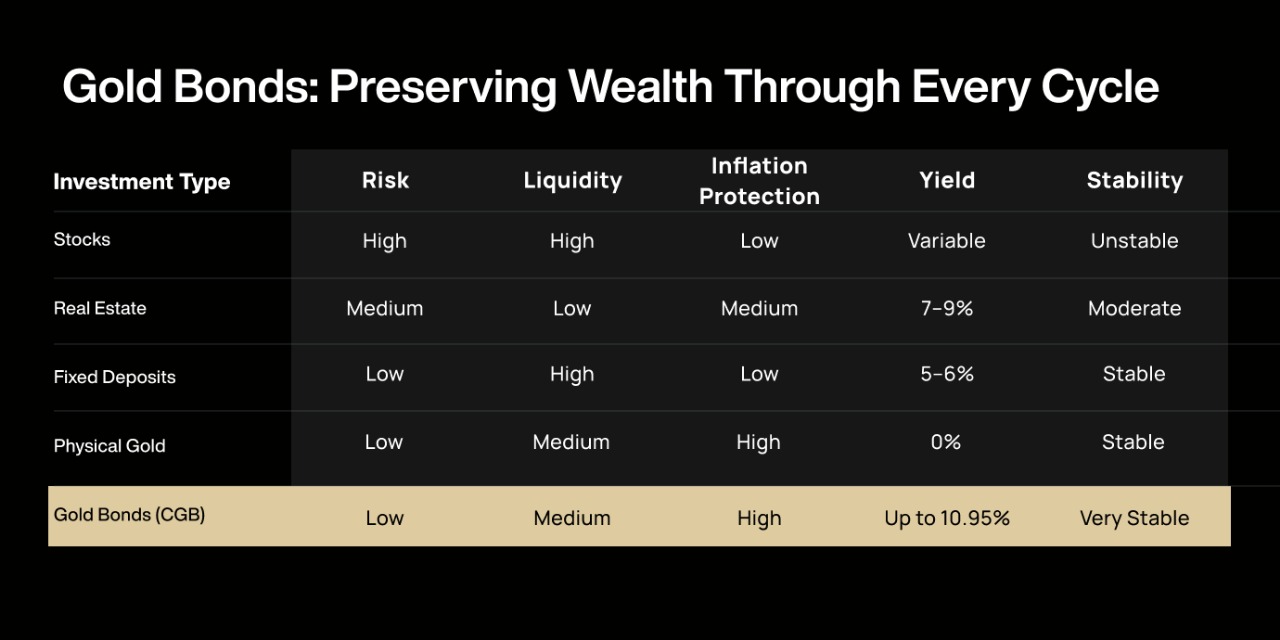

They combine the intrinsic security of gold with the financial intelligence of compounding interest, offering a stable, predictable, and inflation-resistant path to long-term prosperity.

The Quest for Stability in an Unstable Economy

Every economy moves in cycles — periods of expansion, peak, recession, and recovery. While these cycles are natural, they can be brutal on investors who rely solely on volatile assets like stocks or real estate.

During market highs, portfolios may surge. But when recessions strike or inflation eats into returns, years of growth can disappear in months. The key question for smart investors isn’t just how much can I earn — it’s how much can I keep.

That’s where gold-backed investments excel. Unlike paper assets, gold retains its intrinsic value through economic shifts. When paired with structured instruments like gold bonds, it doesn’t just protect wealth — it grows it steadily, unaffected by daily market swings.

Compound Gold Bonds™ (CGB) exemplify this new era of stability-based investing, combining traditional gold security with modern compounding yields of up to 10.95% APY.

Understanding Economic Cycles and Their Impact on Wealth

Economic cycles are inevitable — expansions bring growth and optimism, while contractions test resilience and discipline.

The Four Phases of an Economic Cycle:

- Expansion: Economic growth, rising asset prices, and increased consumer spending.

- Peak: Growth slows, inflation often rises, and valuations become stretched.

- Recession: Economic contraction, declining markets, job losses, and shrinking consumer confidence.

- Recovery: Gradual return to stability, setting the stage for another cycle.

Each phase affects investments differently.

- Stocks thrive in expansion but collapse in recessions.

- Real estate becomes illiquid during downturns.

- Cash loses value when inflation rises.

Investors who rely solely on these instruments often find themselves trapped by timing. True wealth preservation requires an asset that stands apart — one that remains strong through every stage.

That asset has historically been gold.

The Enduring Role of Gold in Preserving Wealth

Gold isn’t just another commodity — it’s the world’s oldest form of money. From ancient empires to modern economies, gold has always represented stability, scarcity, and trust.

Why Gold Thrives When Others Falter:

- Intrinsic Value: Gold isn’t tied to the performance of a company, government, or currency.

- Limited Supply: It can’t be printed or artificially inflated like fiat money.

- Crisis Hedge: When confidence in markets or institutions falters, investors flock to gold.

Consider history:

- During the 2008 financial crisis, gold prices surged as equities plunged.

- In the 2020 pandemic, gold again outperformed, acting as a safe store of value amid global uncertainty.

However, while holding physical gold preserves value, it doesn’t generate value. That’s where gold bonds revolutionize the equation—turning a static store of wealth into a compounding, income-generating asset.

What Are Gold Bonds and How Do They Work?

Gold bonds are financial instruments that merge the stability of gold with the productivity of fixed-income securities.

When you invest in a gold bond, your capital is backed by physical gold or gold-linked assets, providing tangible security. In return, you earn a fixed annual percentage yield (APY)—often compounded for exponential growth.

Types of Gold Bonds:

- Government-Issued Bonds (e.g., Sovereign Gold Bonds – SGBs):

- Backed by the government.

- Offer around 2.5% annual interest plus gold appreciation.

- Typically have long lock-in periods (5–8 years).

- Backed by the government.

- Private Structured Bonds (e.g., Compound Gold Bonds™):

- Backed by real gold assets or gold-secured loans.

- Offer up to 10.95% APY with daily compounding.

- Flexible terms from 6 to 18 months.

- Designed for accredited investors seeking security and high returns.

- Backed by real gold assets or gold-secured loans.

Unlike gold ETFs or physical gold, which only reflect price changes, gold bonds generate actual passive income — combining growth, yield, and stability in one investment.

Gold Bonds Across Different Economic Scenarios

One of the strongest reasons to invest in gold bonds is their ability to perform consistently across all economic climates. Let’s see how they behave during each phase of the cycle:

a. During Inflation

When inflation rises, cash and fixed deposits lose purchasing power. Gold, on the other hand, usually appreciates.

Gold bonds not only benefit from gold’s price stability but also provide fixed interest income, helping you maintain real returns that outpace inflation.

b. During Recession

During downturns, stock portfolios shrink, and real estate demand falls. Gold historically strengthens as investors seek safety.

With gold bonds, you continue earning steady yields — ensuring reliable cash flow even when other markets struggle.

c. During Economic Expansion

When markets recover, gold may stabilize, but gold bonds continue to compound daily.

This consistency allows investors to grow wealth without chasing volatile assets.

d. During Market Volatility

Gold bonds act as a non-correlated asset—their performance doesn’t depend on stock market swings or central bank policies.

That makes them a portfolio stabilizer, providing peace of mind and predictable returns during uncertain times.

Why Gold Bonds Are a Superior Wealth Preservation Tool

Gold bonds sit at the intersection of security, yield, and stability—making them one of the most effective instruments for preserving wealth through economic turbulence.

1. Gold-Backed Security

Each bond is linked to tangible gold reserves, ensuring intrinsic value regardless of market sentiment.

2. Fixed, Predictable Returns

Unlike ETFs or mutual funds, gold bonds pay guaranteed yields—giving retirees and long-term investors confidence in future income.

3. Inflation Hedge

As living costs rise, gold’s value often increases, protecting purchasing power and maintaining real wealth.

4. Compounding Advantage

Daily compounding, as offered by Compound Gold Bonds™, allows your earnings to earn more each day—exponentially increasing long-term returns.

5. Capital Protection

CGB offers first-loss protection, meaning investor principal remains shielded even if market values dip.

6. Portfolio Diversification

Gold bonds are non-correlated with equities or debt markets, reducing overall portfolio volatility.

Using Gold Bonds in a Long-Term Wealth Strategy

A balanced portfolio isn’t just about chasing high returns—it’s about ensuring consistency, protection, and growth across decades. Gold bonds play an essential role in that strategy.

Step 1: Define Your Goals

Determine whether your goal is retirement income, family wealth, or capital preservation. For instance, earning $1,000 per month at 10.95% APY would require roughly $110,000 invested in gold bonds.

Step 2: Choose Suitable Terms

Shorter tenures (6–12 months) provide liquidity, while longer durations (18 months or more) maximize compounding and total returns.

Step 3: Apply a Laddering Strategy

Invest in bonds with staggered maturities—e.g., 6, 12, and 18 months—to ensure continuous cash flow and flexibility for reinvestment.

Step 4: Reinvest Your Earnings

By reinvesting earned interest instead of withdrawing it, your wealth compounds exponentially. Over a 10-year horizon, daily compounding can more than double your returns.

Step 5: Review and Rebalance

Periodically assess your portfolio and rebalance based on market conditions or life goals to ensure optimal performance and stability.

The Compound Gold Bonds™ Advantage

Compound Gold Bonds™ represent the premium evolution of traditional gold investments—engineered for investors who prioritize safety with performance.

Key Features:

- Up to 10.95% APY — among the highest in the gold investment market.

- Daily Compounding Interest — accelerating long-term growth.

- First-Loss Protection — CGB absorbs initial market loss before investors.

- No Fees or Hidden Charges — ensuring transparent, net returns.

- IRA-Eligible — for tax-free or tax-deferred compounding.

- Flexible Terms — from 6 to 18 months for optimal liquidity.

- Accredited Investors Only — ensuring exclusivity and trust.

Illustration:

An accredited investor allocates $100,000 to CGB.

At 10.95% APY, compounded daily, the investment grows to over $286,000 in 10 years — all backed by physical gold and managed with institutional-grade security.

CGB turns gold from a passive store of value into an active engine of compounding wealth.

Gold Bonds in Action: Real-World Wealth Preservation

Let’s consider how gold bonds perform during different real-world events:

- During 2008: As global equities crashed, gold surged nearly 25%, protecting portfolios. Gold bonds would have continued paying steady yields during this time.

- During 2020: Gold prices hit record highs amid pandemic uncertainty. Investors in CGB not only enjoyed gold’s price stability but also earned daily compounded returns, unaffected by market panic.

- During Inflationary Periods: When fiat currencies weaken, gold strengthens—making gold bonds a built-in inflation hedge that retains and grows wealth.

Across every major cycle, the consistent theme is clear: gold bonds preserve and grow value when other assets fail.

Conclusion: Stability Is the New Wealth

In a financial world obsessed with chasing returns, few investors stop to ask the most important question: Will my wealth survive the next downturn?

Gold bonds answer that question with confidence. They represent more than an investment — they are a bridge between timeless value and modern financial intelligence.

By combining gold’s historic stability with structured, compounding yields, Compound Gold Bonds™ empower investors to grow wealth steadily, securely, and predictably — no matter where the economy turns.

Markets will rise and fall. Currencies will fluctuate. But gold, and the steady daily compounding of Compound Gold Bonds™, will continue to safeguard and grow the wealth of those who think long term.

.png)