.webp)

Investing in Gold, Reimagined for Fixed Income.

We’ve simplified the path to earning stable, compounding returns from gold-backed assets — with none of the complexity of traditional gold investing.

.webp)

We’ve simplified the path to earning stable, compounding returns from gold-backed assets — with none of the complexity of traditional gold investing.

The Compound Gold Bonds is built for investors looking for predictable income and long-term stability.

Enjoy an attractive APY backed by gold and related assets, offering stability and growth potential.

Gold has historically been a reliable hedge against inflation, preserving your purchasing power even in uncertain times.

Our portfolio structure includes safeguards, prioritizing the protection of your investment.

Your investment grows faster with daily compounding interest, maximizing returns over time.

Gold has historically been a reliable hedge against inflation, preserving your purchasing power even in uncertain times.

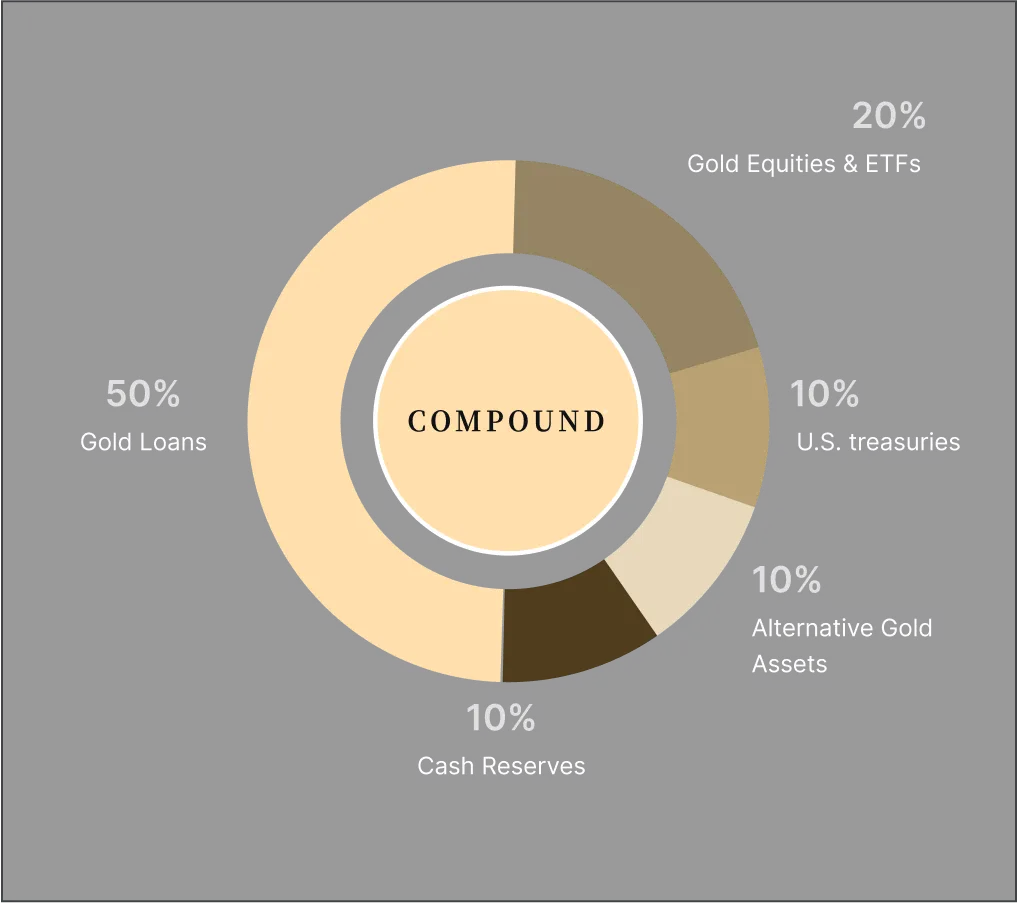

Bonds are backed by a diversified portfolio of income producing Gold assets to mitigate risk.

Every dollar you invest is safeguarded by institutional-grade protection layers:

1. First-Loss Protection: Compound absorbs the first tier of loss.

2. Daily Income Option: Prefer cash flow? Set your interest to be paid out whenever you like.

3. Gold-Collateralized Lending: Every loan is secured by gold assets.

4. Treasury Layer: A portion of the portfolio is held in short-term U.S. Treasuries.

5. Portfolio Diversification: Across asset type, structure, and duration.

No equities. No development risk. No speculation. Just disciplined income generation.

At the heart of Compound Gold Bonds™ is a simple, proven model:

Unlike REITs or funds chasing growth, we focus on one thing: delivering fixed, protected returns.

Every dollar you invest is safeguarded by institutional-grade protection layers:

No equities. No development risk. No speculation. Just disciplined income generation.

Compound Gold Bonds™ adapt to your goals:

Your plan, your terms. No penalties. No surprises.

You’re in control—without needing to manage the day-to-day.

Compound Gold Bonds™ are fixed-income investment instruments that combine the enduring value of gold with the predictability of a set interest rate. Unlike traditional savings accounts, these bonds pay interest that compounds daily, allowing investors to benefit from consistent income growth over time.

The bonds are structured to provide investors with exposure to a diversified portfolio of gold-related assets while maintaining the simplicity of a fixed-rate return. They are designed for accredited investors seeking capital preservation, steady income, and portfolio diversification beyond conventional equities and bonds.

The offer is available only to new individual investor accounts opened through CGB. Existing customers are not eligible.

The $1000 cash bonus will be credited within 30 days after the successful completion of the 180-day holding period.

Compound Gold Bonds™ are designed with capital preservation at the core. Your investment is supported by gold-backed assets and a structure built to provide stability and predictable daily income.

While not covered by FDIC insurance, these bonds emphasize security through tangible asset exposure and disciplined risk management—giving investors confidence in both the strength and transparency of the program.

CGB is available to accredited investors. $1,000 opening investment amounts apply. You can confirm eligibility during account setup.

To qualify, you must open a new account using the CGB link, deposit at least $50,000 USD, and maintain that balance for 180 consecutive days.

No. The promotion is limited to one bonus per natural person, regardless of how many accounts you open.

CGB is not a speculative or crypto product. It’s a professionally managed & institutionally structured, asset-backed fixed income investment. The return is based on income generated from secured gold lending and institutional-grade gold assets.

No. CGB is not FDIC insured because it is not a bank deposit or savings product. Instead, it is a private fixed income investment backed by gold-linked assets. While it’s designed for capital preservation, it carries investment risk like all market-based products. Investors are secured by the underlying portfolio — not by a government guarantee.

The $500 cash bonus will be credited within 30 days after the successful completion of the 180-day holding period.

Your investment grows at a fixed, high APY, compounded daily for maximum growth. Our secure structure ensures your returns remain predictable and transparent, with no hidden fees or market volatility risks.

Compound GSB offers daily compounding interest, high liquidity, and diversification with gold-backed security—benefits that physical gold alone cannot provide.

CGB’s yield is not tied to the daily market price of gold. Your return remains fixed and stable. The portfolio is built for income — not speculation — with allocations to income-generating and defensive assets for downside protection.

If your balance drops below $50,000 at any time during the holding period, you will forfeit the bonus.

Yes, your investment is backed by gold assets and diversified with U.S. Treasuries and cash equivalents. We also implement first-loss protection and FDIC-insured reserves to prioritize your safety.

CGB offers up to 10.95% APY, paid and compounded daily. Your earnings grow every single day — with no waiting periods or payout delays.

Yes. The initial $50,000 deposit and the $500 bonus must remain in your account for at least 6 months (180 days) after the bonus is credited. Withdrawing earlier may result in bonus revocation.

The offer is available only to new individual investor accounts opened through CGB. Existing customers are not eligible.

CGB’s investment structure is managed by a professional team with experience in fixed income, private credit, and gold. The assets are held in structured vehicles with full transparency and oversight.

No. The promotion is limited to one bonus per natural person, regardless of how many accounts you open.

No. CGB charges no management fees, no performance fees, and no hidden costs. 100% of your investment works for you.

No. This bonus cannot be combined with any other new account promotions or incentives.

Yes — depending on the bond term you choose. Some terms offer liquidity after a minimum holding period. All early redemption options are clearly outlined before you invest. A 2% early redemption penalty applies.

Yes. The $500 bonus may be considered taxable income. Please consult your tax advisor for details

If your account is closed or not in good standing at the time of payout, you will not be eligible to receive the bonus.